Satellite-supported systems for Earth observation, navigation and communication are now an integral part of the mobility sector and an important element within the safe operation of all modes of transport: whether in traffic surveillance, management and safety for road and rail transport, in maritime navigation or in aviation.

Satellite-supported value-added services support the efficient and sustainable operation of modes of transport, transport systems, and transport and logistics processes. With their increased reliability and precision, the European satellite navigation system Galileo and the Earth observation program Copernicus, in particular, are driving forward the further integration of satellite-supported services in the transport sector. Future satellite constellations in low-Earth orbits will additionally boost the global availability of communication services for all areas of transport and thus make an important contribution towards networking and safety in the transport sector.

Satellite-supported value-added services on the rise for global traffic management

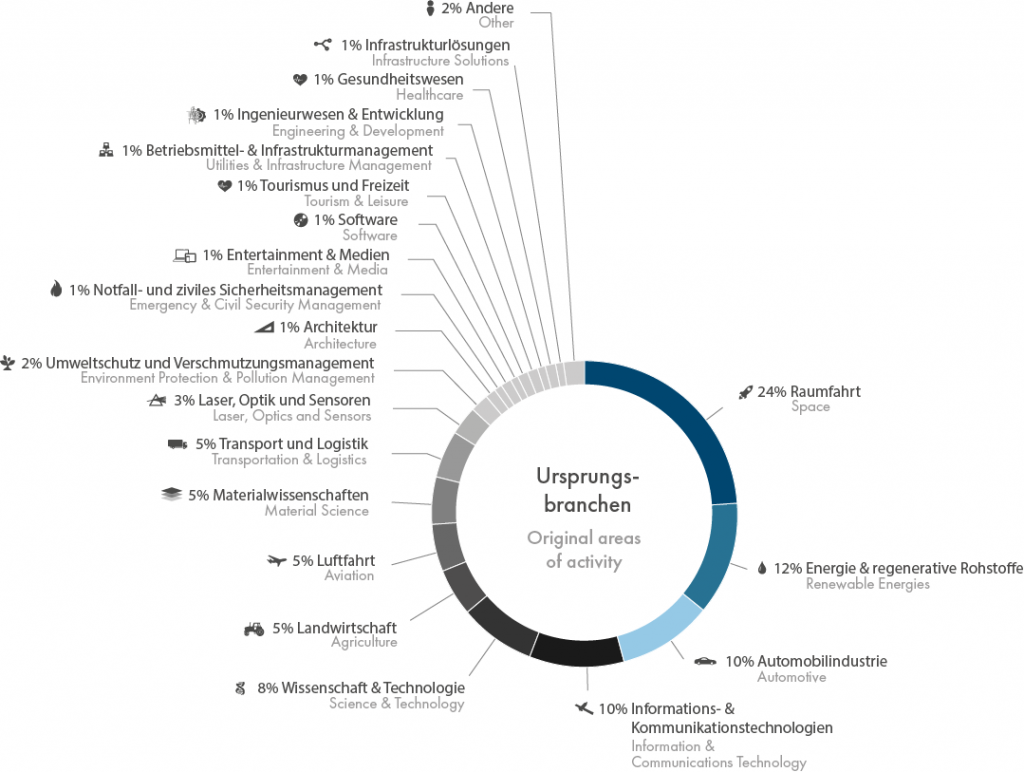

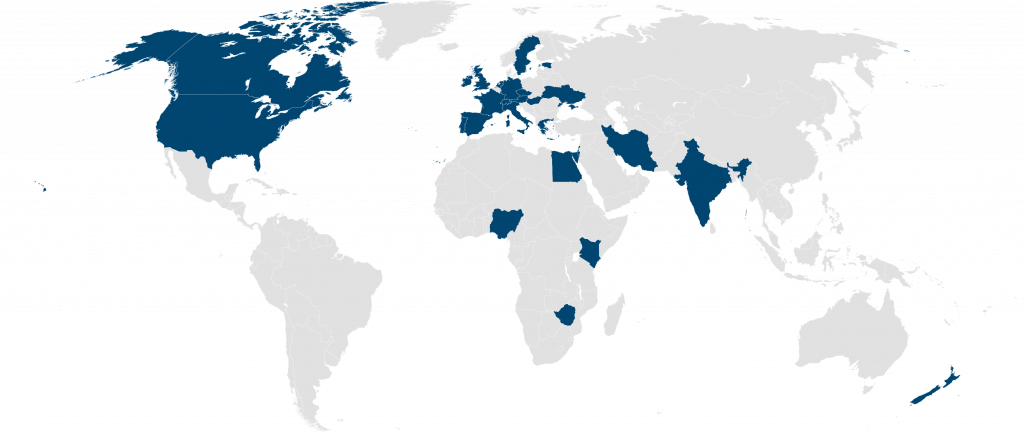

Satellite-supported value-added services are a growth market, which is expected to grow to a market volume of USD 144.5 billion by 2026[1]. The driver on the demand side is the increasing digitalisation of industry and society and the associated easier integration of these value-added services into industrial value creation chains. On the opposite side, supply is driven forward by the further commercialisation of the satellite market, in which private venture capital is increasingly being provided to establish and develop satellite constellations. In this context, alongside established satellite operators, a whole array of new companies in the “new space economy” have been founded over recent years with the aim of revolutionising the Earth observation and satellite communication market in the coming years. Innovative companies from other industries are also entering the space data market in order to refine this information and make it available to their customers as value-added services. This will also offer a significant benefit for various transport sectors – not least the transport and logistics sector around the world.

High-speed Internet for the global automotive, transport and logistics sector

The most prominent example of this new market is the American company SpaceX. The company is currently establishing its satellite constellation Starlink, which will offer global high-speed Internet access in a low-Earth orbit with ultra-modern satellites. The aim is to provide commercial and private users with a high-quality, fast and seamless Internet connection with data transfer rates between 100 to 200 Mbit/s and latencies of 20 ms. For the first time, satellite constellations such as Starlink are offering users access to high-speed Internet, even in the most remote locations, and are thus driving forward a global standard for connectivity. Connectivity that is available worldwide is particularly important for the transport and logistics sector. Long-haul flights, long-distance transport and international cruise ships and cargo vessels, among others, should benefit from this: operators can thus offer seamless Internet access to their logistics fleets – even in regions where no Internet coverage has previously been possible.

Satellite constellations such as Starlink also want to play a key role in the automotive industry. They particularly want to act as drivers of innovation in the introduction of autonomous vehicles and in the transport and logistics sector, for GNSS vehicle tracking and fleet management. As a response to Starlink, two consortia involving established aerospace companies and the “new space economy” have formed in Europe with the aim of establishing their own sovereign European satellite communications infrastructure. A purely German consortium consisting of the Bavarian companies Mynaric, Isar Aerospace and Reflex Aerospace wants to launch the first demonstration satellite for a future network comprising 400 satellites as early as 2023.

Safety-critical applications in the transport sector benefit from new Galileo services

Satellite navigation has made its way into almost all industries over the last 20 years and plays a crucial role in the entire mobility sector. The global market for GNSS chipsets and devices for localisation, navigation and timekeeping already amounted to USD 93.3 billion in 2018 and is set to grow rapidly in the coming years[2]. According to the European Union Agency for the Space Programme (EUSPA), satellite navigation supports over 50,000 jobs in Europe each year[3]. Digital routing of ground, water and air-supported modes of transport with the aid of satellite navigation has significantly contributed to an increase in efficiency and safety within the transport sector. What is more, high-precision GNSS time signals are not only essential to precisely determine the position of vehicles, but also to manage and link up transport systems. The current GNSS signals are provided by a range of global satellite navigation systems (Galileo, GPS, GLONASS, BeiDou), regional systems (e.g. QZSS and IRNSS) and satellite-based augmentation systems (SBAS), such as EGNOS or WAAS. The services offered by the European Galileo System promise new opportunities for growth within the transport sectors in Europe with their high integrity, availability and precision. This applies, in particular, to safety-critical applications, such as the management of rail transport, autonomous driving or automated ship manoeuvres in ports.

Innovative service providers within the mobility sector also benefit from new satellite-supported services. New services are being developed, for instance, by the teleoperation provider Fernride from Munich. The company offers a cloud-based platform to reliably control vehicles in the logistics sector remotely. Customers benefit from an automated 24/7 vehicle control system, the efficiency benefits that this brings, and a simultaneous reduction in operational workload.

Earth-observation services for safer, more efficient traffic management worldwide

The increasing number of Earth observation satellites has significantly increased the availability of precise, highly up-to-date information about our home planet over the last 10 years. A variety of value-added services have arisen from this enormous amount of data, bringing about a considerable increase in safety within global air, maritime and ground-based traffic. Satellite-supported weather forecasts provide important data for this, such as information about the paths of hurricanes, storm and thunder cells, wave heights and ice predictions on the oceans, and hail, snow and heavy rainfall. This particularly benefits global aviation and airport management, traffic surveillance and management for road transport, and safe routing in maritime navigation. A variety of smaller service providers have been founded for this in Europe over recent years. Specialised services have developed as a business model, using Earth observation data to offer tailored information for certain market segments and customer groups. The ESA BIC alumni Drift+Noise from Bremen, for instance, offers shipping companies a 10-day ice drift prediction for the polar region based on the Copernicus Marine Service. This enables time-saving and resource-efficient routing and increases safety within polar maritime navigation. Another of many examples is the Bavarian company Wxfusion, which provides airport operators, airlines and pilots around the world with real-time predictions of the paths of thunder cells. This offers customers numerous benefits, which particularly allow aircraft to be operated safely and more efficiently. Earth observation data in combination with ground-supported information sources and real-time information, which is provided by the various modes of transport during ongoing operations, opens up potential for many other value-added services in the future.

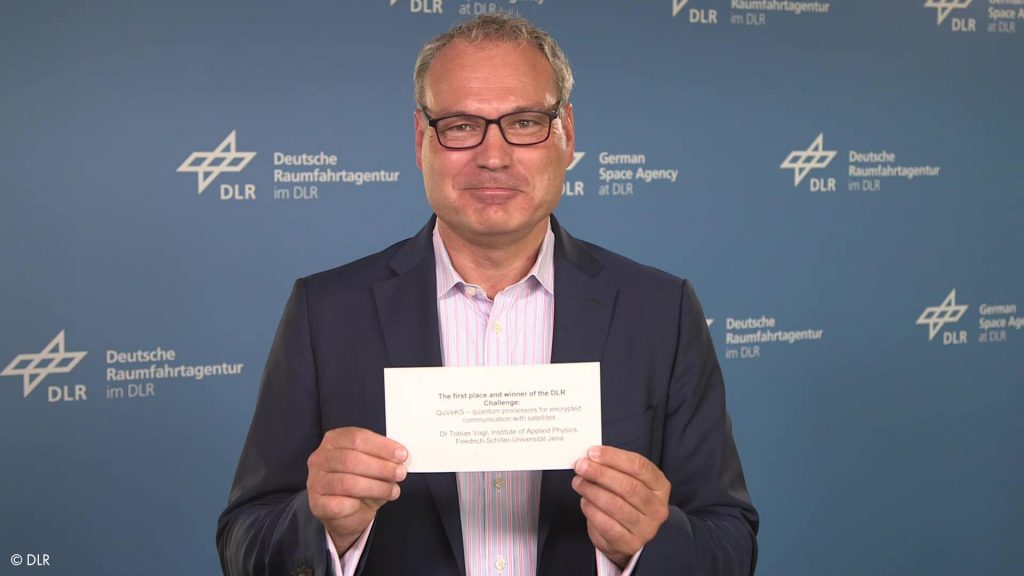

Identifying services, which advance sustainability through novel application concepts for space technology and Earth Observation data, is a central pillar of the innovation contest INNOspace Masters. Through its five themed challenges, the international competition is looking for transfer-based innovations in different maturity stages. Submissions can either rely on a spin-off transfer (from space to other industries) or a spin-in transfers, where technology and know-how from other industries is introduced to the space industry. For example, this year the Mercedes-Benz car2space Challenge is searching for space-based services for the automotive industry – among other topics. The competition awards the top three ideas of each partner challenge. In addition to the price pool of up to EUR 400,000, each winner can also count on technical support for the implementation of their vision. All information regarding the challenges can be found here.

[1] markets.businessinsider.com

[2] Market Report GSA GNSS

[3] EU Agency for the Space Programme